|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statoil |

: |

Brigham Exploration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dealogic Deal # : |

772455 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data as of : |

10/17/2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

|

|

|

Acquiror |

|

|

|

|

|

Dates & Values |

|

|

|

|

|

|

|

Brigham

Exploration |

|

|

Statoil |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target: |

100 |

% stake |

|

|

|

|

|

Buying: |

100 |

% stake |

|

|

|

Rumored |

- |

|

Deal Value $m |

4,668.3 |

|

|

NS |

BEXP |

117 |

m shares outstanding |

|

Public (Listed) |

|

Announced |

17th Oct 2011 |

|

Value ex Debt $m |

4,430.6 |

|

|

United States |

|

Norway |

|

|

|

|

|

|

|

|

|

|

Oil & Gas |

|

Oil & Gas |

|

Expected |

4Q 2011 |

|

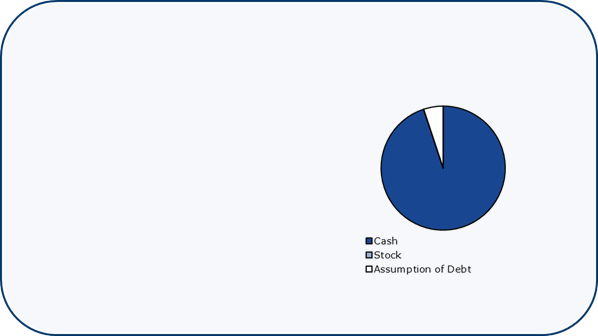

Consideration |

|

|

|

|

Jefferies | Advisor |

|

|

|

|

|

|

|

Goldman Sachs | Advisor |

|

|

|

Completed |

- |

|

|

|

|

|

|

|

|

Thompson & Knight |

Attorney |

|

|

|

|

|

Tudor Pickering |

Advisor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vinson & Elkins |

Attorney |

|

|

|

Withdrawn |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Target $m |

tbd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Acquiror $m |

tbd |

|

|

|

|

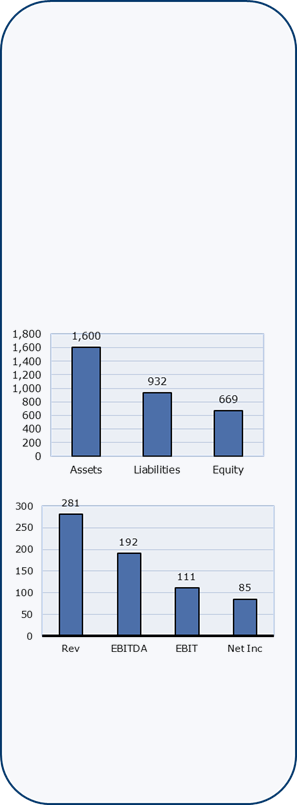

Financials |

30th Jun 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

Debt/Equity: |

1.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timeline Events |

|

|

|

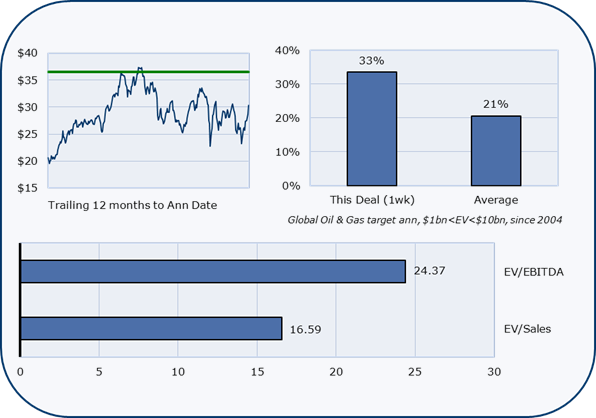

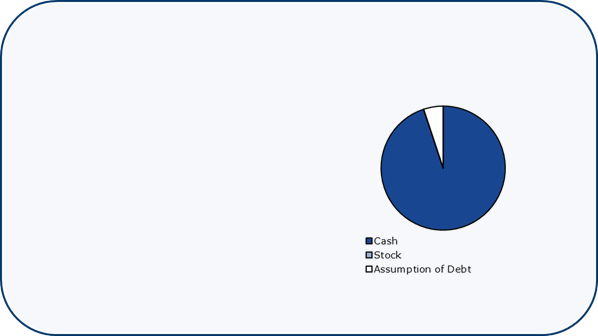

Premiums & Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Offer |

|

$37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Offer |

|

$37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations $m |

|

238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit Margin |

|

38% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

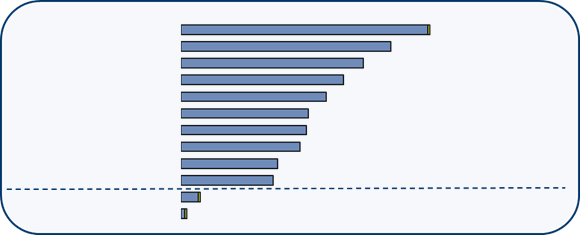

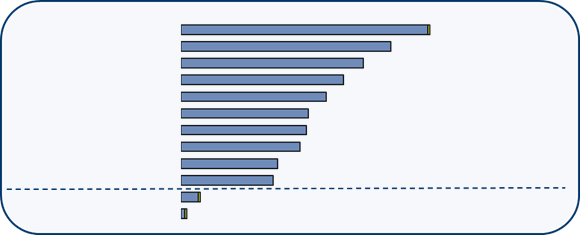

League Table Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector Trend |

|

|

|

|

|

|

|

2011 YTD Announced Global M&A by Deal

Value, $bn |

|

|

|

|

|

|

|

|

Monthly Announced Global M&A, $bn: |

Oil & Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Goldman Sachs |

|

|

|

|

|

|

|

|

|

|

|

594.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

JPMorgan |

|

|

|

|

|

|

|

|

|

|

|

|

502.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Morgan Stanley |

|

|

|

|

|

|

|

|

|

|

|

436.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Credit Suisse |

|

|

|

|

|

|

|

|

|

|

|

388.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Citi |

|

|

|

|

|

|

|

|

|

|

|

|

|

347.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Barclays Capital |

|

|

|

|

|

|

|

|

|

|

|

305.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

BOA Merrill Lynch |

|

|

|

|

|

|

|

|

|

|

|

300.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Deutsche Bank |

|

|

|

|

|

|

|

|

|

|

|

284.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

UBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

231.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Lazard |

|

|

|

|

|

|

|

|

|

|

|

|

220.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

Jefferies |

|

|

|

|

|

|

|

|

|

|

|

|

45.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

Tudor Pickering |

|

|

|

|

|

|

|

|

|

|

13.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2011 Dealogic.

All rights reserved. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|