|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UnitedHealth Group |

: |

Amil Participacoes (90%) |

|

|

|

|

|

|

|

|

Dealogic Deal # : |

833851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data as of : |

10/8/2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

|

|

|

Acquiror |

|

|

|

|

|

Dates & Values |

|

|

|

|

|

|

|

Amil

Participacoes (90%) |

|

|

UnitedHealth

Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target: |

90 |

% stake |

|

|

|

|

|

Buying: |

90 |

% stake |

|

|

|

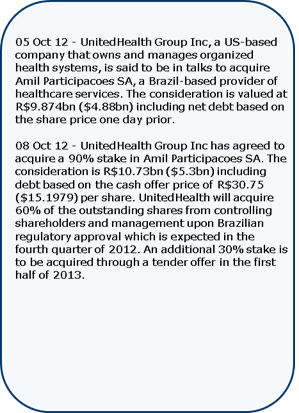

Rumored |

6th Oct 2012 |

|

Deal Value $m |

5,303.6 |

|

|

PL |

AMIL3 |

361 |

m shares outstanding |

|

Public (Listed) |

|

Announced |

8th Oct 2012 |

|

Value ex Debt $m |

4,933.2 |

|

|

Brazil |

|

United States |

|

|

|

|

|

|

|

|

|

|

Healthcare |

|

Healthcare |

|

Expected |

1Q 2013 |

|

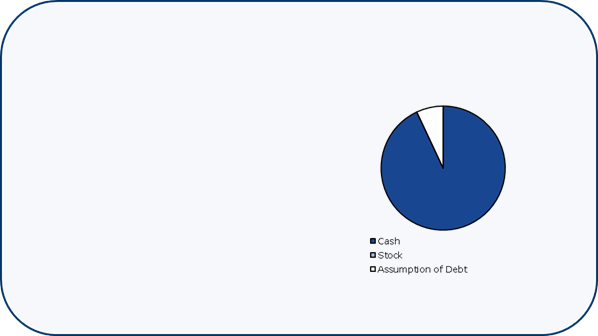

Consideration |

|

|

|

|

Credit Suisse | Advisor |

|

|

|

|

|

|

JPMorgan | Advisor |

|

|

|

Completed |

- |

|

|

|

|

|

|

|

|

Linklaters | Attorney |

|

|

|

|

|

|

|

Sullivan & Cromwell |

Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

Lefosse Advogados |

Attorney |

|

|

|

|

|

Pinheiro Neto | Attorney |

|

|

|

Withdrawn |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Target $m |

tbd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Acquiror $m |

tbd |

|

|

|

|

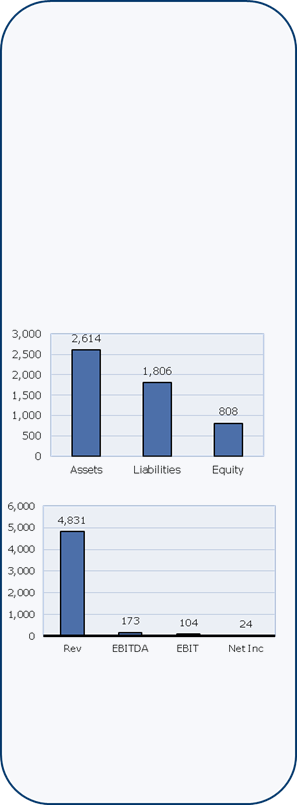

Financials |

30th Jun 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

Debt/Equity: |

2.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

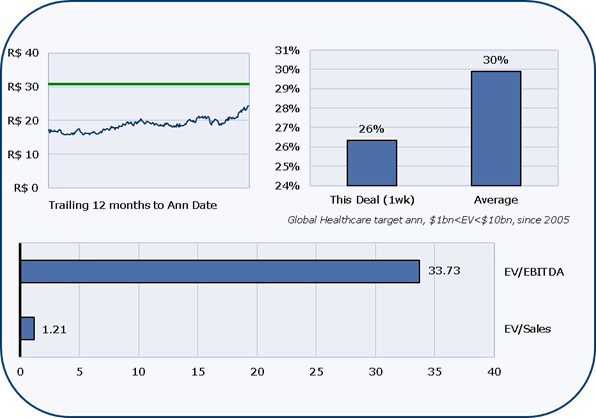

Timeline Events |

|

|

|

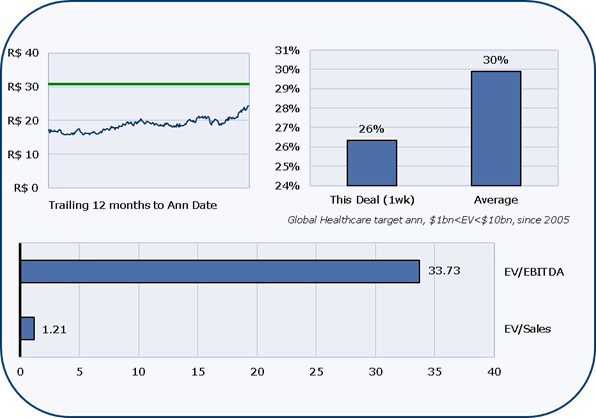

Premiums & Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Offer |

|

R$ 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Offer |

|

R$ 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations $m |

|

255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit Margin |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

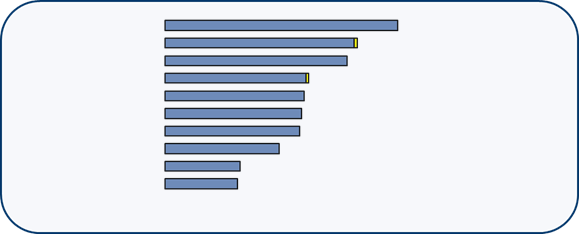

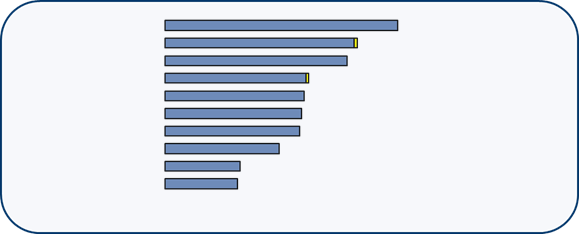

League Table Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

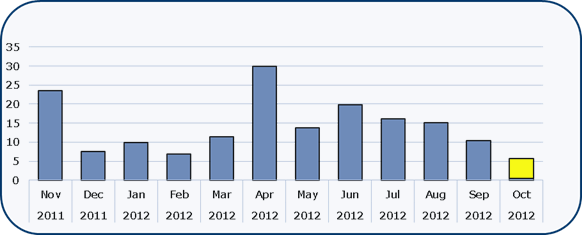

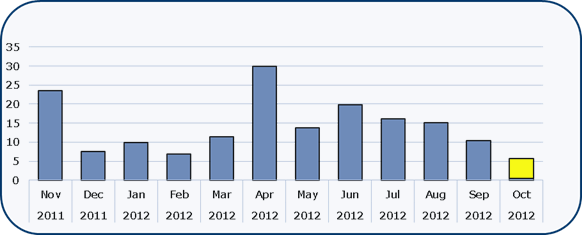

Sector Trend |

|

|

|

|

|

|

|

2012 YTD Announced Global M&A by Deal

Value, $bn |

|

|

|

|

|

|

|

|

Monthly Announced Global M&A, $bn: |

Healthcare |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Goldman Sachs |

|

|

|

|

|

|

|

|

|

|

|

463.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

JPMorgan |

|

|

|

|

|

|

|

|

|

|

|

|

381.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Morgan Stanley |

|

|

|

|

|

|

|

|

|

|

|

362.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Credit Suisse |

|

|

|

|

|

|

|

|

|

|

|

286.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Deutsche Bank |

|

|

|

|

|

|

|

|

|

|

|

276.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Citi |

|

|

|

|

|

|

|

|

|

|

|

|

|

271.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Barclays |

|

|

|

|

|

|

|

|

|

|

|

|

268.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

BAML |

|

|

|

|

|

|

|

|

|

|

|

|

|

227.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Rothschild |

|

|

|

|

|

|

|

|

|

|

|

|

149.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Lazard |

|

|

|

|

|

|

|

|

|

|

|

|

143.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2012 Dealogic.

All rights reserved. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|