|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Superior Energy Services |

: |

Complete Production Services |

|

|

|

|

|

|

Dealogic Deal # : |

771194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data as of : |

10/10/2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

|

|

|

Acquiror |

|

|

|

|

|

Dates & Values |

|

|

|

|

|

|

|

Complete

Production Services |

|

|

Superior

Energy Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target: |

100 |

% stake |

|

|

|

|

|

Buying: |

100 |

% stake |

|

|

|

Rumored |

- |

|

Deal Value $m |

3,183.4 |

|

|

NY |

CPX |

79 |

m shares outstanding |

|

Public (Listed) |

|

Announced |

10th Oct 2011 |

|

Value ex Debt $m |

2,703.9 |

|

|

United States |

|

United States |

|

|

|

|

|

|

|

|

|

|

Oil & Gas |

|

Oil & Gas |

|

Expected |

4Q 2011 |

|

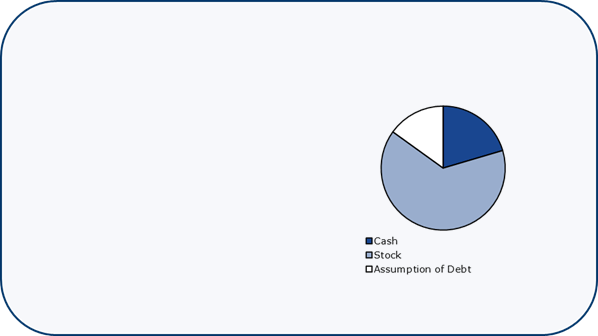

Consideration |

|

|

|

|

Credit Suisse | Advisor |

|

|

|

|

|

|

Greenhill | Advisor |

|

|

|

Completed |

- |

|

|

|

|

|

|

|

|

Credit Suisse | Fairness

Opinion |

|

|

|

|

|

JPMorgan Chase | Advisor |

|

|

|

|

|

|

|

|

|

|

|

|

|

Latham & Watkins |

Attorney |

|

|

|

|

|

Greenhill | Fairness

Opinion |

|

|

|

Withdrawn |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jones Walker | Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Target $m |

tbd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Acquiror $m |

tbd |

|

|

|

|

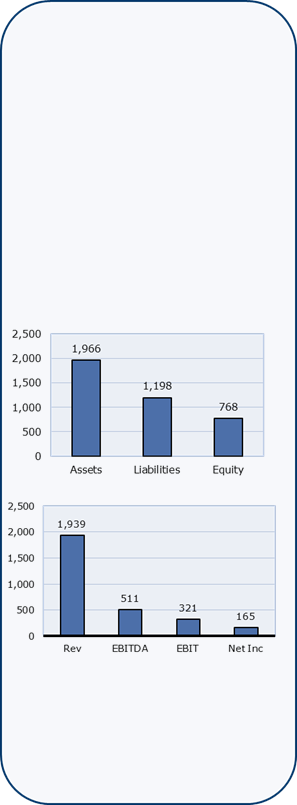

Financials |

30th Jun 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

Debt/Equity: |

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timeline Events |

|

|

|

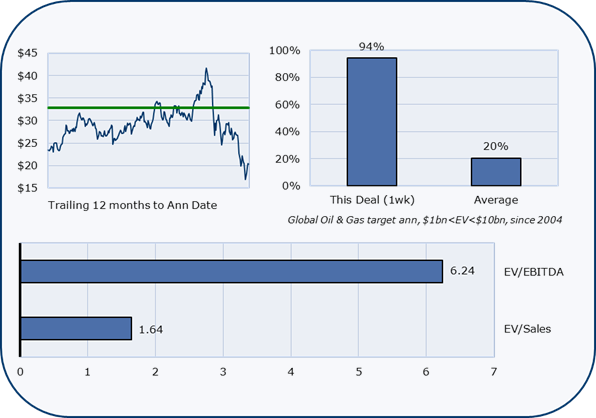

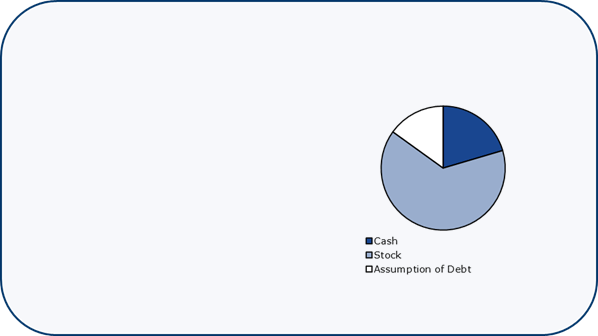

Premiums & Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Offer |

|

$33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Offer |

|

$33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations $m |

|

302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit Margin |

|

14% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

|

21% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

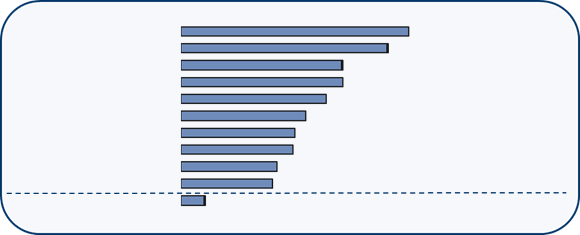

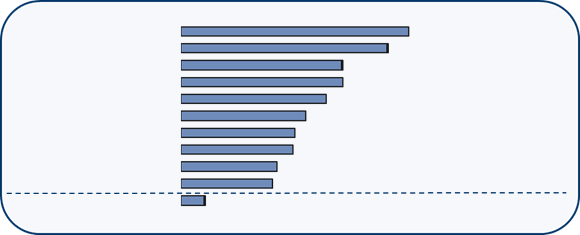

League Table Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector Trend |

|

|

|

|

|

|

|

2011 YTD Announced Global M&A by Deal

Value, $bn |

|

|

|

|

|

|

|

|

Monthly Announced Global M&A, $bn: |

Oil & Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Goldman Sachs |

|

|

|

|

|

|

|

|

|

|

|

544.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

JPMorgan |

|

|

|

|

|

|

|

|

|

|

|

|

495.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Credit Suisse |

|

|

|

|

|

|

|

|

|

|

|

386.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Morgan Stanley |

|

|

|

|

|

|

|

|

|

|

|

386.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Citi |

|

|

|

|

|

|

|

|

|

|

|

|

|

346.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

BOA Merrill Lynch |

|

|

|

|

|

|

|

|

|

|

|

298.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Deutsche Bank |

|

|

|

|

|

|

|

|

|

|

|

272.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Barclays Capital |

|

|

|

|

|

|

|

|

|

|

|

268.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

UBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

228.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Lazard |

|

|

|

|

|

|

|

|

|

|

|

|

218.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

Greenhill |

|

|

|

|

|

|

|

|

|

|

|

|

58.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2011 Dealogic.

All rights reserved. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|