|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dalian Wanda Group |

: |

AMC Entertainment Holdings |

|

|

|

|

|

|

|

|

Dealogic Deal # : |

806663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data as of : |

5/22/2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

|

|

|

Acquiror |

|

|

|

|

|

Dates & Values |

|

|

|

|

|

|

|

AMC

Entertainment Holdings |

|

|

Dalian

Wanda Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target: |

100 |

% stake |

|

|

|

|

|

Buying: |

100 |

% stake |

|

|

|

Rumored |

8th May 2012 |

|

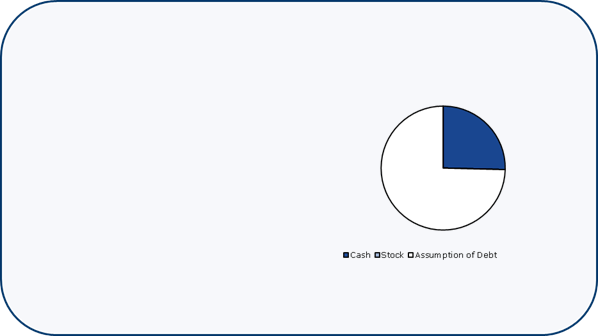

Deal Value $m |

2,600.0 |

|

|

Unlisted |

0 |

0 |

m shares outstanding |

|

Private (Not listed) |

|

Announced |

20th May 2012 |

|

Value ex Debt $m |

660.3 |

|

|

United States |

|

China |

|

|

|

|

|

|

|

|

|

|

Leisure & Recreation |

|

Real Estate/Property |

|

Expected |

3Q 2012 |

|

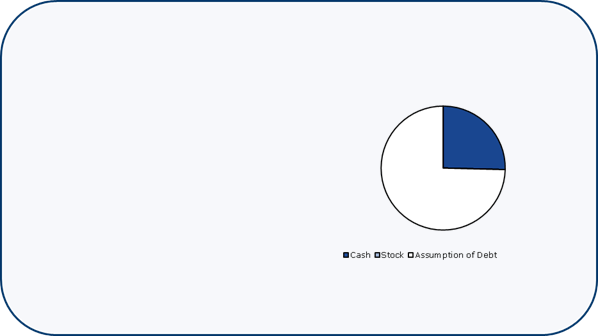

Consideration |

|

|

|

|

Citigroup Global Markets |

Advisor |

|

|

|

|

Ernst & Young |

Advisor |

|

|

|

Completed |

- |

|

|

|

|

|

|

|

|

Weil Gotshal & Manges |

Attorney |

|

|

|

|

Davis Polk & Wardwell |

Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Withdrawn |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Target $m |

tbd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Acquiror $m |

tbd |

|

|

|

|

Financials |

29th Sep 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

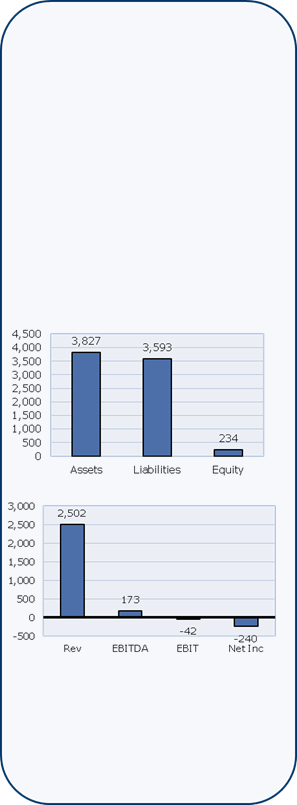

Balance Sheet |

|

Debt/Equity: |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timeline Events |

|

|

|

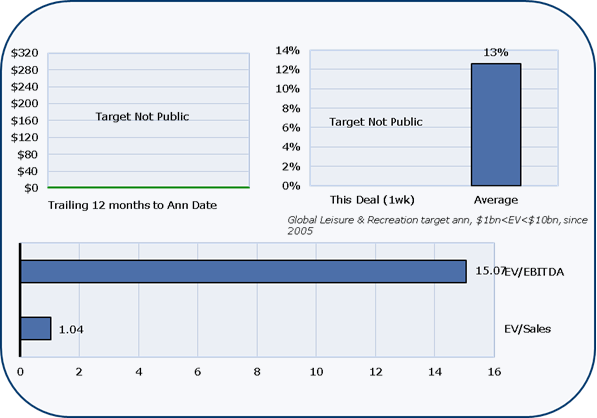

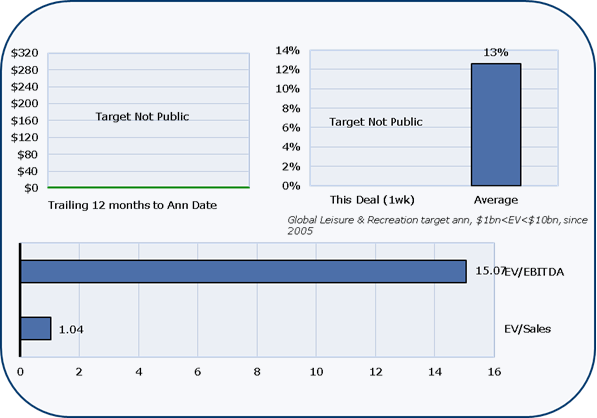

Premiums & Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Offer |

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Offer |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations $m |

|

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit Margin |

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

|

-103% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

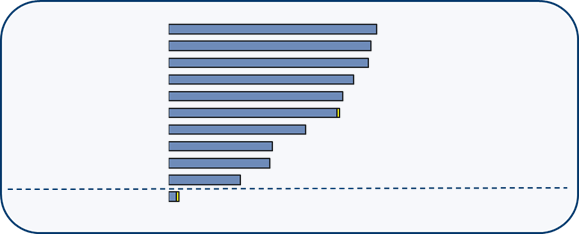

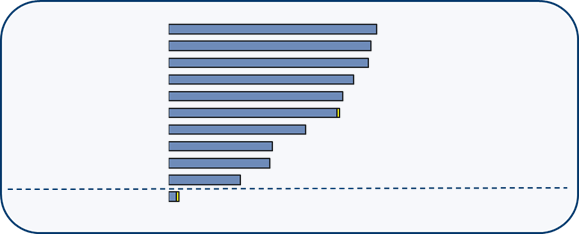

League Table Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

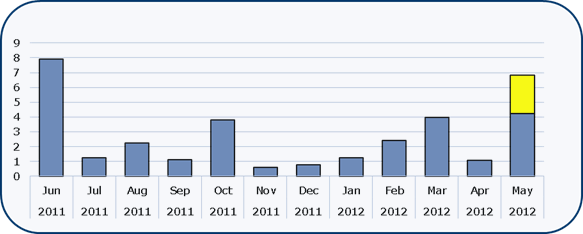

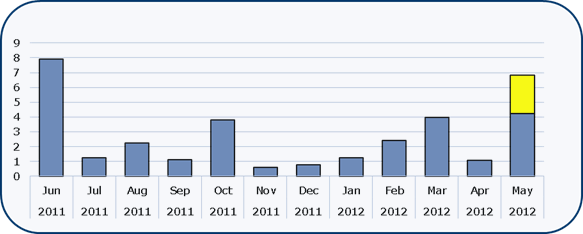

Sector Trend |

|

|

|

|

|

|

|

2012 YTD Announced Global M&A by Deal

Value, $bn |

|

|

|

|

|

|

|

|

Monthly Announced Global M&A, $bn: |

Leisure & Recreation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Goldman Sachs |

|

|

|

|

|

|

|

|

|

|

|

198.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Morgan Stanley |

|

|

|

|

|

|

|

|

|

|

|

193.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

JPMorgan |

|

|

|

|

|

|

|

|

|

|

|

|

191.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Credit Suisse |

|

|

|

|

|

|

|

|

|

|

|

176.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Deutsche Bank |

|

|

|

|

|

|

|

|

|

|

|

166.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Citi |

|

|

|

|

|

|

|

|

|

|

|

|

|

163.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Barclays |

|

|

|

|

|

|

|

|

|

|

|

|

131.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

BAML |

|

|

|

|

|

|

|

|

|

|

|

|

|

98.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Nomura |

|

|

|

|

|

|

|

|

|

|

|

|

96.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

BNP Paribas |

|

|

|

|

|

|

|

|

|

|

|

|

68.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

Ernst & Young |

|

|

|

|

|

|

|

|

|

|

|

9.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2012 Dealogic.

All rights reserved. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|