|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

: |

Coventry Health Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dealogic Deal # : |

824611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data as of : |

9/26/2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target |

|

|

|

|

|

|

|

Acquiror |

|

|

|

|

|

Dates & Values |

|

|

|

|

|

|

|

Coventry

Health Care |

|

|

Aetna |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target: |

100 |

% stake |

|

|

|

|

|

Buying: |

100 |

% stake |

|

|

|

Rumored |

- |

|

Deal Value $m |

5,726.4 |

|

|

NY |

CVH |

134 |

m shares outstanding |

|

Public (Listed) |

|

Announced |

20th Aug 2012 |

|

Value ex Debt $m |

5,726.4 |

|

|

United States |

|

United States |

|

|

|

|

|

|

|

|

|

|

Healthcare |

|

Insurance |

|

Expected |

2Q 2013 |

|

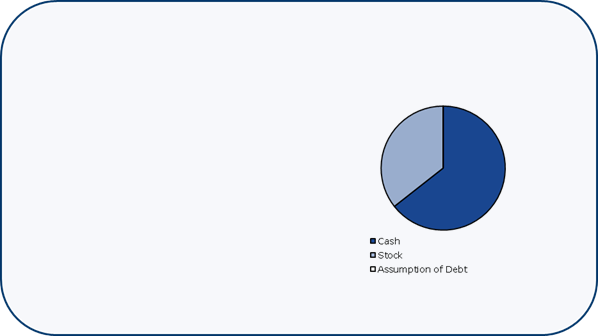

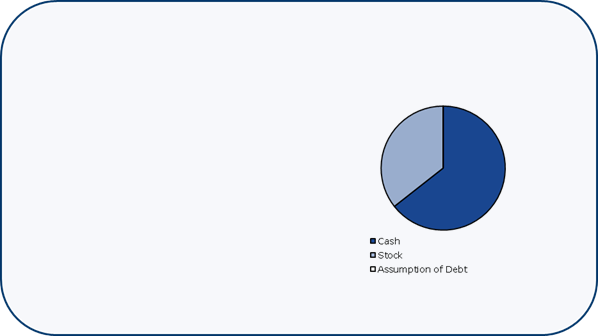

Consideration |

|

|

|

|

Greenhill & Co |

Advisor |

|

|

|

|

|

|

Goldman Sachs | Advisor |

|

|

|

Completed |

- |

|

|

|

|

|

|

|

|

Bass Berry & Sims |

Attorney |

|

|

|

|

|

UBS | Advisor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crowell & Moring |

Attorney |

|

|

|

|

|

|

Davis Polk &

Wardwell | Attorney |

|

Withdrawn |

- |

|

|

|

|

|

|

|

Wachtell Lipton Rosen & Katz | Attorney |

|

|

|

Jones Day | Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Target $m |

tbd |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Termination Fee, Acquiror $m |

tbd |

|

|

|

|

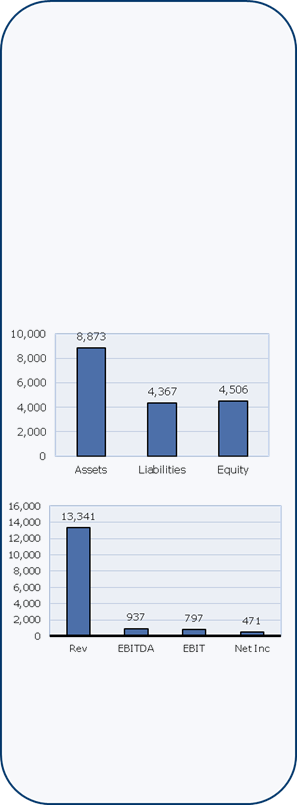

Financials |

30th Jun 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

Debt/Equity: |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Timeline Events |

|

|

|

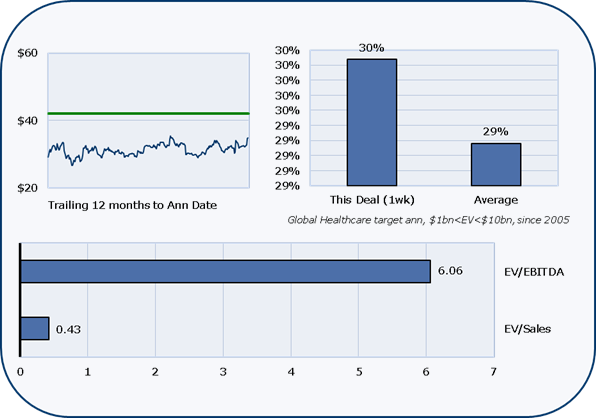

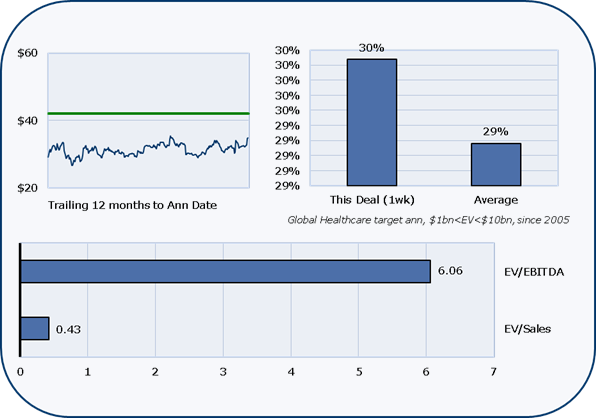

Premiums & Multiples |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial Offer |

|

$42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Offer |

|

$42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations $m |

|

696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit Margin |

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

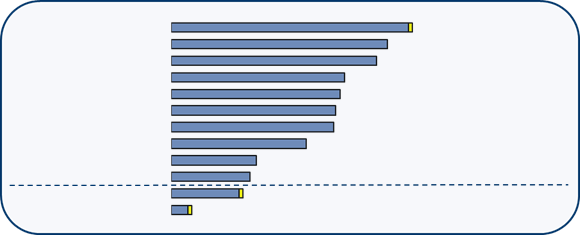

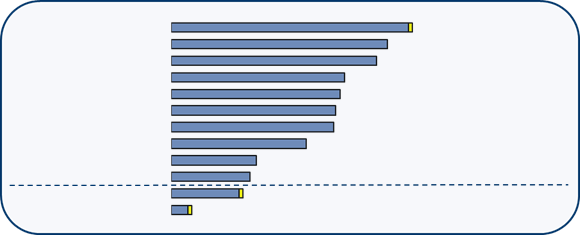

League Table Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

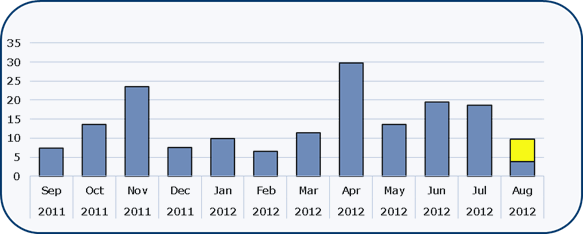

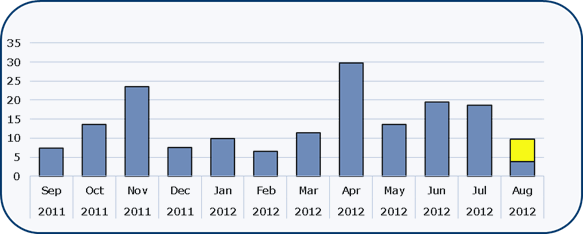

Sector Trend |

|

|

|

|

|

|

|

2012 YTD Announced Global M&A by Deal

Value, $bn |

|

|

|

|

|

|

|

|

Monthly Announced Global M&A, $bn: |

Healthcare |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Goldman Sachs |

|

|

|

|

|

|

|

|

|

|

|

361.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

JPMorgan |

|

|

|

|

|

|

|

|

|

|

|

|

323.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Morgan Stanley |

|

|

|

|

|

|

|

|

|

|

|

307.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Deutsche Bank |

|

|

|

|

|

|

|

|

|

|

|

259.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Credit Suisse |

|

|

|

|

|

|

|

|

|

|

|

253.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Barclays |

|

|

|

|

|

|

|

|

|

|

|

|

246.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Citi |

|

|

|

|

|

|

|

|

|

|

|

|

|

243.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

BAML |

|

|

|

|

|

|

|

|

|

|

|

|

|

202.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Rothschild |

|

|

|

|

|

|

|

|

|

|

|

|

127.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Nomura |

|

|

|

|

|

|

|

|

|

|

|

|

117.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

UBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

107.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

Greenhill & Co |

|

|

|

|

|

|

|

|

|

|

|

30.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2012 Dealogic.

All rights reserved. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|